TRADES EXECUTION

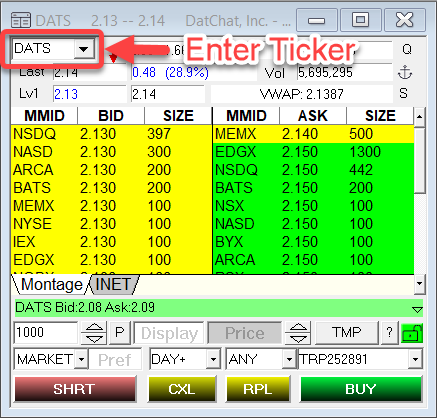

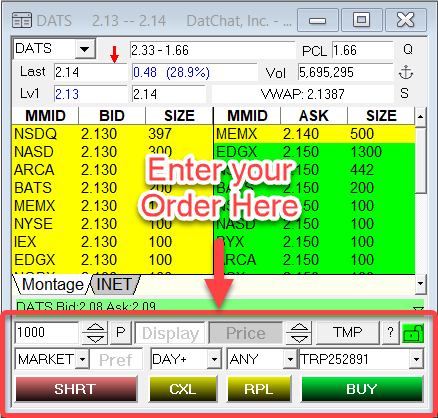

This is an example of an Order Window with Time-and-Sales flow. This particular example is from DAS Trader PRO software.

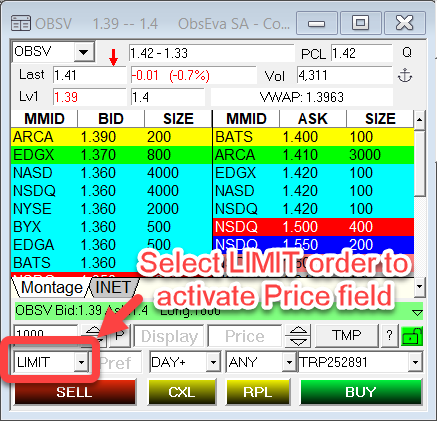

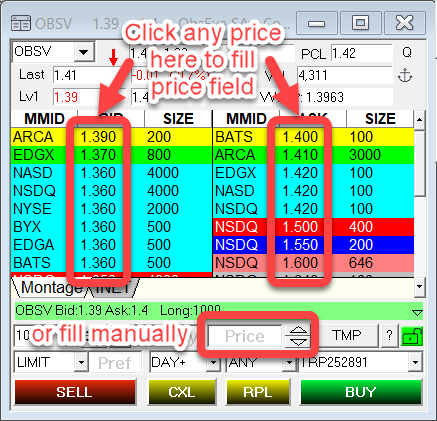

Below you can see the selection field for the Type of Order you want to make and for the Execution Route you want to take.

Order Types can be:

-

- Limit Order (recommended always!)

- Market Order (you leave the option to the broker to execute at the price they have/want; not recommended)

- Stop Order (used to stop out of a position when trade goes wrong; not recommended for beginners

Route choices are many to choose from and you will find your own preference over time and experience. For beginners, you can set to Auto during market hours and ARCA during After Hours.

The tall window on the right side is the Time-and-Sales window. It shows all the trades executed on the market in chronological order.

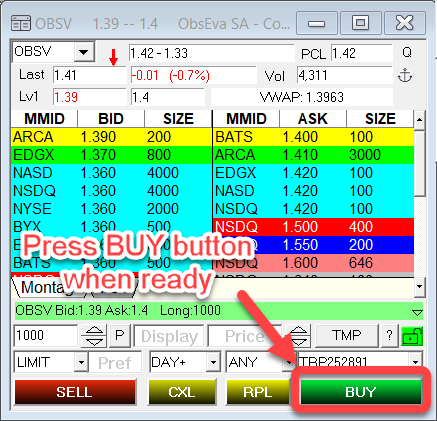

Here is how to enter your order:

First you need to enter the ticker you want to Buy/Sell. This is the code that represents the name of your instrument. You can find the ticker for a company or instrument name through market scanners or by searching on google for the name of the company/instrument. Once you know the ticker, enter it as shown below and hit enter. The whole Bid/Ask table will now show price action for the selected ticker.

Then start filling the details of you order as shown below. You will need to decide on the following fields:

-

- Number of Shares to Buy/Sell

- Type of Order to send (Limit, Market or Stop); a Limit Order is always recommended!

- Limit Price, meaning the Price at which you want to Buy/Sell

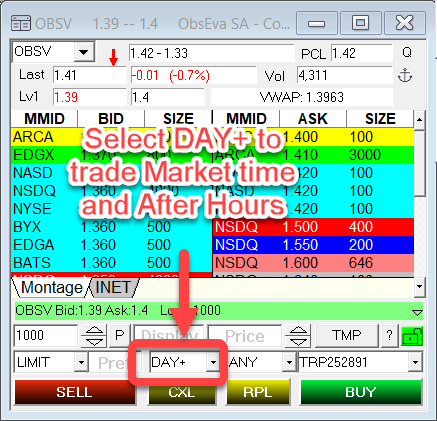

- Period of order validity (Market time, Until cancelled, After Hours…)

- Account to use (if having several accounts)

Level 1 and Level 2 are two ways of showing price action. Both sections are part of the Order Window. In Level 1 you will only see the top Bid and Ask prices/sizes and the Last Price transacted.

Level 2 will be showing Bid and Ask of all Market makers.

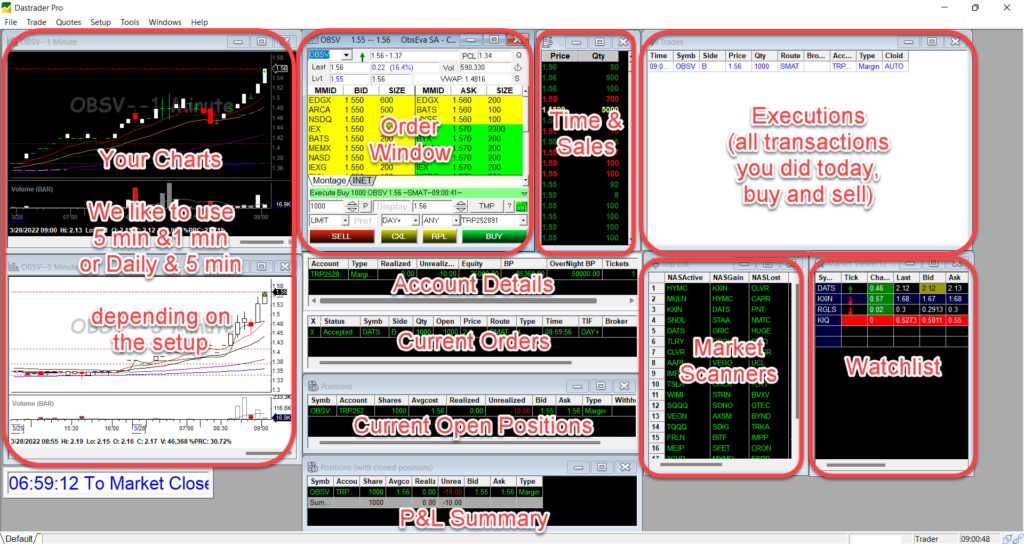

Your Trading Screen is the main screen in your Trading Software, which is related to your broker and holds your trading account. It could be a live account or a demo account. Here we are demonstrating a standard setup in DAS PRO software. In addition to this, you will most probably have at least another charting and/or scanning software showing on your monitor(s).

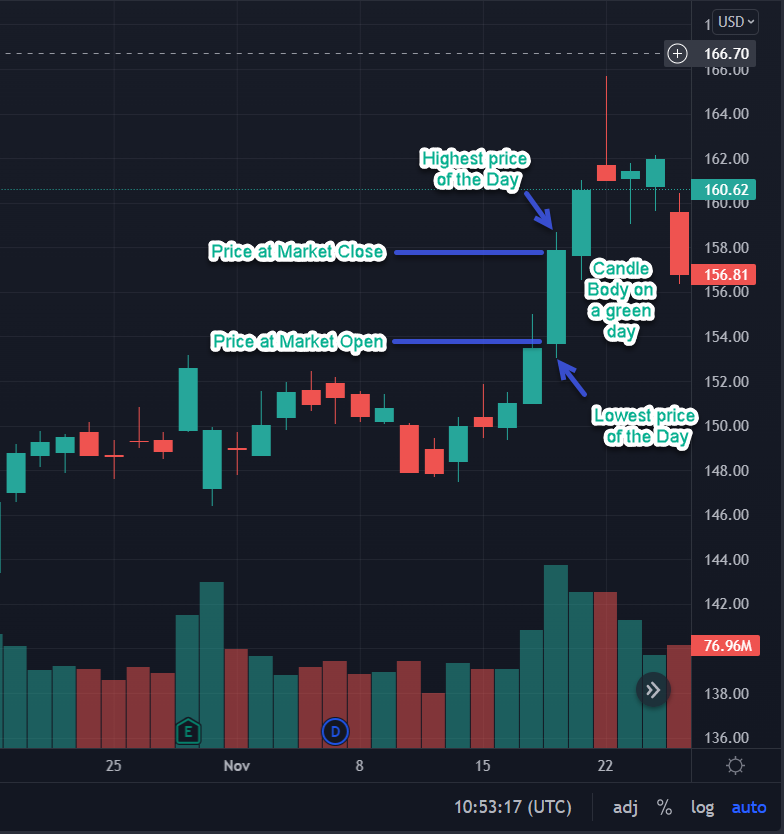

Pre and Post Market are very important to understand the movement of an instrument. Some instruments like Crypto and Currencies operate on a 24h schedule so Pre and Post market don’t apply in those cases. But in all the cases where they do apply, it is very important that you follow the price action during those periods.

Market time goes from 9:30 AM EST to 4:00 PM EST.

Most brokers will allow trading from 7:30 AM to 5:30 PM. If you can, we do recommend that you find a broker with the widest trading schedule. At some point in your trading career, it will make a big difference to be able to trade full extended hours. Not many brokers offer this advantage. One we know is Interactive Brokers. If your initial deposit can’t reach their standards yet, got with a broker that at least offers 7:00 AM to 5:30PM.

On your charting software, you will want to activate pre an post market charting to have a wholesome understanding of price action.

STRATEGY

Position Sizing and Instrument Price range selection is something you will learn over time and experience as it involves many factors to consider in order to make profitable choices. For starters, we will give you the following advice:

-

- If you are trading a micro account, less than 5000$, dedicate your trades to small cap shares or instruments, below 4$ per share. The idea is dedicating not more than 1/3 of your capital to a single position. Mainstream advice is never to trade with more that 1% of your capital, however this is impossible to achieve with micro accounts.

- For starters, think in terms of positions of 1000 shares each. If you like to scale in and out of positions, get starter positions of 500 shares, building it up to 2000 shares. That being said, we do not recommend scaling for micro accounts. Wait until your account grows to 20 000$ before using that strategy, otherwise you expose yourself to blowing up your profits with commission costs. With practice, you will learn to gage the effect of commission and position size on profits.

- Do not try to trade high cap shares with micro or small accounts, meaning less than 80 000$, even if tempted to buy the latest mainstream news share.

One of the first decisions you must make when you start trading is defining whether you want to Invest or Trade/Day Trade. There is a big difference between both and it is the first step to start defining your strategy.

If you want to be an Investor, you will choose stocks or instruments that will be profitable long term without you having to micro manage them. You can implement this kind of strategy if you have a bigger account upwards of 100 000$. In smaller accounts, this strategy is very difficult to implement in a profitable way, because you don’t have enough leverage to make reasonable profits or profits you can live from in a reasonable amount of time. The kind of shares or instruments that give the stability you are looking for in growth are mostly large cap higher priced stocks/instruments for which you have to be invested for months/years to get a enough % gain. As well, you might need to diversify and have a wider invested portfolio in order to manage risk, which again, requires lots of capital to be invested over months/years. That being said, it is not easier to build a good balanced portfolio that is profitable for living than Trading/Day Trading. The difference is the amount of capital you are managing and the timeframes you are considering.

If you want to be Trader/Day Trader, you will be looking for stocks or instruments that can give you profits within minutes, days or weeks at most. This is what we recommend for growing micro or small accounts. It is also a good approach for bigger accounts since it has the potential for profits in the range of 10%-30% daily on a steady basis if you have a strong, well defined and well executed strategy. That being said, we need to issue a disclaimer. Trading is risky and there is no such thing as a certain gain. In fact, most of trader, if not properly trained, will loose money. You will reach steady profitability only if you do things right. And even then, there will always be certain trades that will fail in spite of good prospective. It is like like any other business; there is a cost and there is a revenue. It is a matter of balance to get sustainable profits. So, bottom line, work hard on defining your strategy and practice, practice and practice. What is sure is that a Trader/Day Trader approach is much more viable for smaller accounts. From there on, you need to distinguish between Momentum Trades intraday (in and out of a position in seconds, minutes or hours) and Swing Trades (in and out of a position over more than a day). Both can be viable, it is a matter of personal preference and personal availability for trading time. If you are on a 9 to 5 job and are starting to trade on the side, Swing Trading would be your best choice. If you have at least half day to be in front of the screen, then you could do both.

At JustGo Algo, we firmly believe in Technical Trading, which means that we think that price action is highly influenced by technical indicators and fluctuation cycles.

Many of you may be more familiar with Fundamental Trading, or at least the idea of it, since mainstream media tends to promote this idea. Fundamental Trading means that one is looking at factors like Company strength, financial balances, Revenue, Profitability, Growth, who is the company, who are the directors, Board’s press releases, what products the company sells, its competitive advantage and so on. While some of this plays a role mainly in high cap Companies/shares, our experience shows that it is not a main driver of trading profitability within the Trading/Day Trading approach. If Fundamental Trading is your goal, you should be implementing it within an Invertors approach, with high cap shares and a bigger account. Do not expect short term gains from a Fundamental approach.

Technical Trading is our favorite approach, since it allows you to identify cycles and take advantage of fluctuations within different timeframes of your choice. With Technical Trading, you are relying on your chart and pattern reading skills. The reason for price action is found in mathematical cycles; news, politics and events come on top for the story. While there is a branch of technical trading that also uses news releases as an indicator of price action, the fundamental price response is due to the readiness of a mathematical/statistical cycle. There is many classis indicators you can start with to build your strategy, ranging from simple moving averages to more complex Fibonacci retracements. We encourage you to use a combination of your favorites to start your strategy, and build it up by adding on top of it or refining cycles. For starters, if you have no clue where to start, plot our favorite Moving Averages as explained earlier in this section ( 8 MA, 9EMA, 20MA, 50MA and 200MA) as well as Bollinger Bands. Then, try our algorithm JustGoAlgo – Explorer to start defining your strategy.

Long and Short are two basic terms you need to know in Trading. Long refers to taking a position at a lower price and planning to exit the position at a higher price; Buying Long means you are expecting the price to go up to make profit. The opposite way to take positions is going Short. That means that you are entering high and expecting to exit low to make profit. The Long scheme is pretty natural to understand because all commercial transactions in the world work the same way, you buy from a provider at a lower price and you sell for profit at a higher price; this in trading is called going Long. For going Short, you need to first Sell to the market someone’s shares (shares that they are willing to lend; you need to borrow “unused” shares) at the highest price possible, then Buy them back from the market to give them back. The transaction, if successful, will give you profit, but will also cost you some interest for borrowing the shares. Many traders choose Shorting as their main specialty. While most of people would naturally lean towards taking Long positions, Shorting sometimes has its advantages and can be quite profitable. It will be up to you to choose your specialty and what you are best at, however we recommend you start by learning Long strategies. Shorting needs a good understanding of the market, brokers, fees and executions. It typically involves additional fees and needs good brokerage accounts that you might find difficult to get with small capital.

Our preference and specialty is for the Long positions regardless. Our algorithms reflect those strategies and only give Long signals.

At JustGo Algo, our specialty is American Stocks. NASDAQ, NYSE, AMEX Stock Exchanges are our favorite. While we know very well other types of instruments because we study them for the purpose of our algorithms, we chose American Stocks to be our specialty when we trade live. The reason is that we found in those exchanges/specialty the right balance of opportunity per price level, leverage, profit potential, availability through our brokers, trading fees, and volume for our personal style and setting.

Choosing your specialty is of utmost importance especially when you are starting. You need to narrow down your daily attention to a select numbre of shares/instruments. It will be much easier for you to focus enough attention on your specialty to thoroughly understand the game before you add on another type of instrument. After getting your charting subscription on, explore different types of instruments and find a favorite path. Make sure you pay attention to how much leverage you need to get your daily profit goals; that means how much capital you need to put into the instrument to get your target profitability, and how frequently that level of profitability can be reached. For example, trading Forex and Spot Currencies needs lots more leverage than trading stocks and offer less volatility. That means that to reach the same daily goals as in stocks, you will need a bigger account (or a bigger margin, which means borrowed money), and holding the positions for a longer time. However you might personally want to chose this specialty whatsoever because you understand its price action so well that you are the most successful at it. There is where it becomes a personal choice. The only firm recommendation we want to give you is explore well all the possibilities then DO choose a specialty instrument, whichever fits your style and you think you can be successful at, but DO choose one. you need to start with one and if you want then diversify, but you need to narrow down to a first focus to be successful.

Here are some categories to get you started. Keep in mind that you should be as specific as you need to narrow down the number of instruments you are looking at each day. So eventually, we recommend you not only choose a specialty instrument type like Forex, Crypto, Stocks, Commodities, Gold, but also narrow down a price range and at least 3 other parameters.

Types of Instruments to get you started:

-

- Stocks

- Options

- Forex or Spot Currencies

- Cryptocurrencies

- Commodities

- Gold

- Oil

- Indexes

- ETFs

- NFTs

There are lots of different markets, exchanges and even more sectors to choose from when it comes to trading. The word Markets is the most widely used and can refer to different things. One way of using this term is referring to a group of exchanges from a specific country, for example when we talk about the American stock market, we refer to the group of Stock Exchanges based in the USA, which would include NASDAQ Stock Exchange, NYSE, AMEX, OTC and a few more. Each of those markets however doesn’t include only American Stocks. There are companies from around the world that decide to trade on American markets, so you can find stocks from other countries trading on NASDAQ as well as you can find American stocks trading in foreign Stock Exchanges.

Layered trough the Stock Exchanges and location Countries you have Sectors. Companies that trade on a certain market pertain to a Sector, like companies dealing with Oil and Gas Equipment will pertain to the Oil and Gas Sector or as well could pertain to the Equipment Sector. Sectors price action most often works as a unity, which means that a price trend going on right now in a share from a certain sector would replicate in other shares from the same sector. With time and experience you will learn how Sectors trends rotate and how shares from a single sector impact each other.

We recommend that you do choose a specialty in terms of Instrument Type, Exchange and/or Country of Exchange, but keep some diversification in terms of sectors, since they tend to rotate in profitability throughout the year. Diversifying sectors allows you to follow those burst trends and have the possibility to find the best profitability all year round.

Here are some steps to follow to narrow down your strategy:

-

- Get started with TradingView, TC2000 or with your favorite charting software to be able to enter tickers and see charts.

- Use free web resources like FinViz.com to find tickers, and get acknowledged with Instrument Types, Sectors, Stock Exchanges, Timeframes, daily % gain, float, filters and scanners.

- Open a Demo account and start trying out some trades on your favorite Instrument Type, Sector and Stock Exchange

- Start with a demo account the size of your real initial capital and a second account with the default demo capital.

- Try out trades in both and examine results

- Narrow down your focus to a specific price range in accordance with your live capital.

- Use JustGoAlgo – Explorer to find entry and exit points and narrow down your daily goals expectation within an instrument type, sector, or timeframe.

- Setup or use a prebuilt scanner to show your narrowed down results for your daily watchlist.

- Adjust your focus or try another instrument if results need improvement.

Using scanners is an essential part of a trader’s daily routine. There are several thousands of tickers in each stock exchange or near to one thousand cryptocurrencies. As a trader, you need to narrow down your daily focus to just a few of them, less than ten we would recommend. That’s what the scanners, filters, heatmaps and screeners are for. There are several platforms that offer scanning capabilities from free resources to paid services. Here are just a few good examples we can recommend:

-

- TC2000 by Worden

- TradingView

- FinViz.com (free web resource)

- Trade Ideas

- Your own broker platform (some of them)

We used all of these scanning platforms at one point in our career and they are all recommendable for different types of strategies. For our current strategies, we found the best fit with TC2000. This is the platform on which we developed our Daily High Probability Scanner that we screenshare in a JustGoAlgo -Explorer subscription.

If you are just beginning your trading journey, you will soon find out that your own psychology will highly impact your trading results. You will most probably be tempted to buy and sell at wrong times. Your impulses will end up defining or busting your strategy. We strongly recommend that you both build a strategy that is in accordance with your own preferences and comfort zone in terms of risk tolerance, and base it on solid technicals and rules. Then you need to practice, practice and practice executing it without trespassing your own rules(believe us, it is not as easy as it sounds; it requires practice and discipline!). You will need to set rules for yourself in terms of:

-

- max loss

- max daily loss

- max risk per trade

- daily profit target

- monthly profit target

- max number of trades per day or per selected timeframe

- market indicators that make it a non-trade day for your strategy

Our best advice: practice, practice, practice, discipline, strong setup, respect your own rules every time! That should keep you out of trouble enough to remain sustainably profitable over time.